How Car Scams Trick You and What You Can Do

Apr 30, 2024

As an Amazon Associate, Modded gets commissions for purchases made through links in this post.

Car scams are more common than you might think. It affects thousands of car buyers every year. Scammers have devised various methods to trick unsuspecting buyers, whether tampered odometers or deceptive online listings.

Being well-informed about these scams is your best defense. Knowing what to look out for helps you avoid falling victim and empowers you to make smarter, safer purchasing decisions. Stay alert and educate yourself on the latest scamming techniques to protect your investment and ensure a legitimate and satisfactory car buying experience.

Common Types of Car Scams

Here are some of the most common car scams you might encounter when looking to buy a vehicle. Understanding these can help you spot red flags early and avoid fraudulent deals.

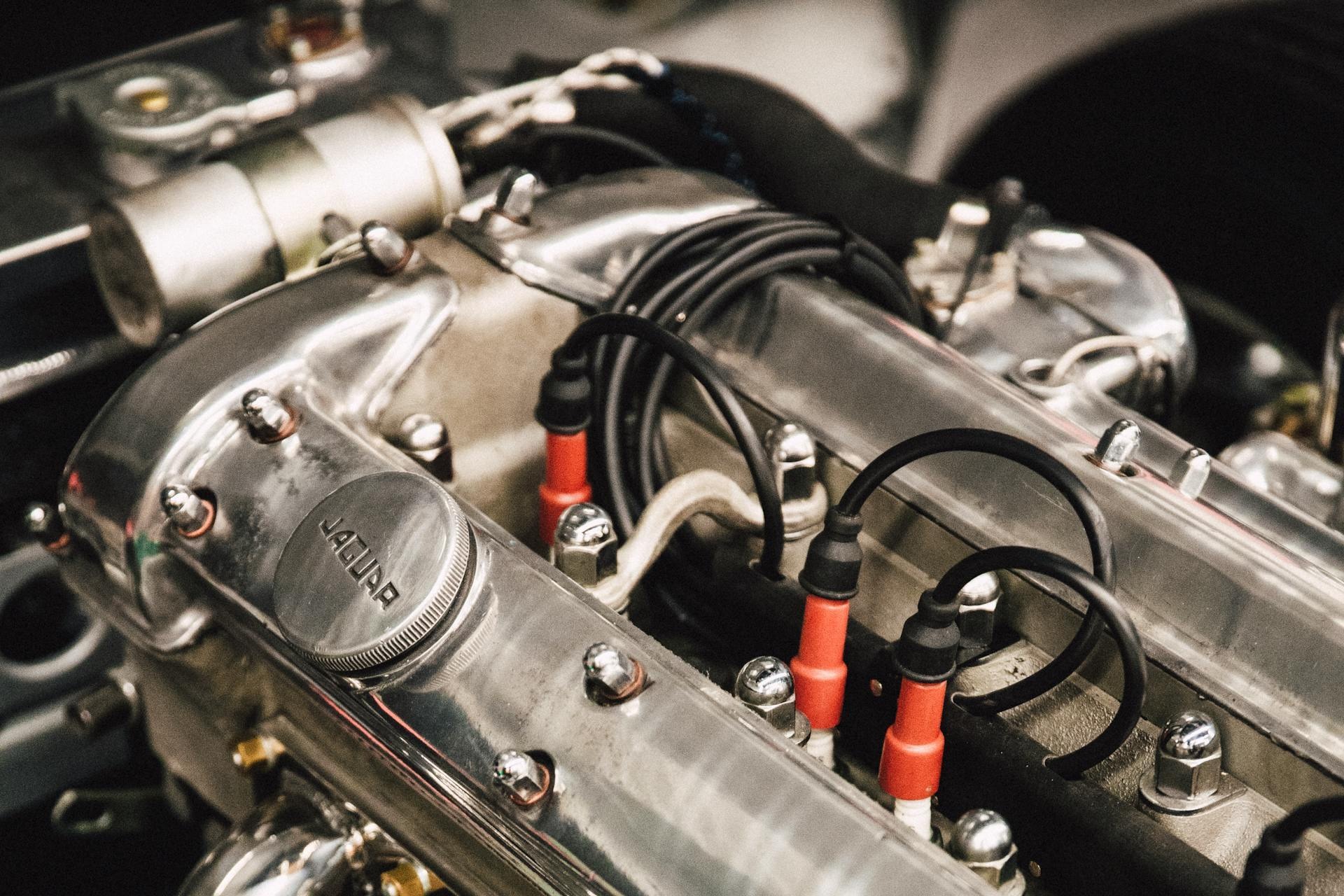

Odometer Fraud

Scammers often roll back a vehicle’s odometer to falsely lower its mileage and make it appear less used and more valuable. This deceptive practice can inflate the car’s sales price. It dupes you into paying more for a vehicle that’s potentially endured much more wear and tear than you think.

Shockingly, over 2.1 million vehicles on the road today have rolled-back odometers. So, when you’re checking out a used car, it’s crucial to compare the odometer reader with the general condition of the vehicle and service records to ensure everything adds up.

Title Washing

Fraudsters often use “title washing” to disguise the troubled pasts of vehicles by eliminating any record of a salvage title. This document indicates that a car has sustained significant damage. It’s typically from an accident or natural disaster and was deemed a total loss by an insurance company.

By manipulating or falsifying documents, scammers can re-register these cars in states with lax regulations to obtain a clean title. It makes the vehicle appear undamaged and more valuable to unsuspecting buyers like you. Always insist on a vehicle history report and consider an inspection by a trusted mechanic to uncover any hidden issues.

Online Sales Scams

Beware of fake listings and sellers who demand deposits without intending to deliver the vehicle. This common online scam involves creating attractive but fraudulent ads for cars at prices that seem too good to miss. Once you show interest, the scammer pressures you to make a quick deposit to secure the deal.

They often require untraceable payment methods like wire transfers or digital currencies. Unfortunately, once you send the deposit, the seller vanishes, and the car you thought you were buying doesn’t exist. Always verify the legitimacy of the listing and the seller before making any payments. Likewise, meet in person and see the vehicle before money changes hands.

Spot Delivery Scam

In recent years, the popularity of used vehicles has increased, as evidenced by over 38 million used cars sold in the U.S. in 2022. When purchasing a second-hand vehicle, you might encounter the spot delivery scam known as yo-yo financing.

In this scenario, dealers let you take possession of a car under the initial assumption that your financing is approved, giving you the keys to drive off the lot. However, they might contact you days or weeks later, claiming the financing went through.

At this point, they demand either that you return the vehicle or accept new, often less favorable financing terms that may include higher fees or interest rates. Ensure both parties fully approve and document the financing terms before taking possession of the car. Be wary of any dealer who rushes you to take a car home before you confirm the financing.

How Scammers Execute These Frauds

Perpetrators often create a sense of urgency and pressure to rush your decisions, making it harder for you to spot red flags or think critically about the transaction. They might claim that other buyers are interested and you must act quickly to secure the deal.

Additionally, these fraudsters may forge or alter documents — such as service histories or ownership papers — to deceive you into believing the car is in better condition or has a cleaner history than it does.

They also exploit online platforms and digital tools to craft sophisticated and legitimate-looking ads or profiles. For example, 25% of car fraud victims in 2021 reported their troubles began on social media. Always take the time to review every detail and verify the authenticity of the information and documents before making any commitments.

Red Flags to Watch Out For

Be cautious of the lure of significantly low prices, as they can often be a sign of a scam. Sellers who pressure you for quick sales and discourage proper inspections typically try to hide something. Always insist on having a trusted mechanic inspect the vehicle before making decisions.

Additionally, be wary of payment requests via wire transfer or cryptocurrencies.

Scammers prefer these methods because they’re hard to trace and nearly impossible to recover. Always opt for more secure and traceable payment methods to protect yourself from potential fraud.

Preventative Measures You Can Take

It’s crucial to obtain a detailed vehicle history report from a reliable source before finalizing any car purchase. This report provides a comprehensive overview of the car’s accident and damage history, helping you make an informed decision.

Additionally, arranging for an independent mechanic to inspect the car can uncover potential issues that aren’t obvious at first glance. Always use secure and traceable payment methods when it’s time to pay. These steps protect your investment and ensure you’re fully aware of the car’s condition before you commit to buying.

What to Do if You Fall Victim to Car Scams

If you fall victim to a car scam, taking immediate action can help you manage the situation more effectively:

- Contact local police: Report car scams by visiting your local police station. Provide all relevant details and documentation to file a report.

- Reach out to the Federal Trade Commission (FTC): File a complaint online at the FTC’s Complaint Assistant website or call their toll-free number.

- Stop transactions and recover funds: Contact your bank or payment service immediately to inform them of the fraudulent activity. Depending on the timing and method of payment, they can stop the transaction or initiate a chargeback.

- Report the scam on the platform: Suppose the fraud occurred through an online marketplace or social media. Report the scam directly on the platform. Provide all evidence and details to help them take action against the scammer and alert other users.

These steps can help mitigate the damage and increase your chances of recovering your funds or stopping further fraudulent activities.

Share the Knowledge with Friends and Family

Don’t keep this valuable information to yourself. Share it with your friends and family to help them stay protected against car scams. Spreading awareness can save someone you care about from these deceptive practices.